Latest News

CHECK OUT SOME OF OUR NEWS

-

07/30/2020 East Asia Minerals Closes Financing & 2M+ warrants exercised

East Asia Minerals Corporation (the “Company”) – Further to the Company’s news release dated July 16, 2020, the Company is pleased to announce the completion of the private placement offering in the amount of $109,999.89 to be used for costs related to the environmental licence (AMDAL) and the preliminary mining reclamation planning process at the…

-

Lode Gold signs Letter of Intent to Execute Tax Efficient Spin-Out, Creating Two Pure Play Companies

Toronto, Ontario – (Newsfile Corp. – Sept 23, 2024) – Lode Gold Resources Inc. (TSXV: LOD) (OTCQB: SBMIF) (“Lode Gold ” or the “Company”) is pleased to announce its wholly-owned subsidiary, (“1475039 B.C. Ltd.” or “Gold Orogen”) has entered into a non-binding Letter of Intent (LOI) on September 23, 2024 to acquire Great Republic Mining…

-

Cerro de Pasco closes $3-million financing with Sprott

2024-09-26 10:47 ET – News Release Mr. Guy Goulet reports CERRO DE PASCO RESOURCES ANNOUNCES $3.0 MILLION PRIVATE PLACEMENT WITH ERIC SPROTT Cerro de Pasco Resources Inc. has closed a non-brokered private placement of 20 million units of the corporation at a price of 15 cents per unit for total gross proceeds of $3-million. Eric…

-

Pinnacle Silver and Gold Provides Corporate Update; Grants Options

PINNACLE SILVER AND GOLD PROVIDES CORPORATE UPDATE AND GRANTS INCENTIVE STOCK OPTIONS Pinnacle Silver and Gold Corp. has provided an update on corporate activities. As previously stated, the company is actively engaged in seeking out new silver and gold exploration and development opportunities in the Americas, with particular focus on Mexico and Peru. Mexico is…

-

Baru Gold Announces Private Placements

BARU GOLD ANNOUNCES PRIVATE PLACEMENT Baru Gold Corp. has arranged a non-brokered private placement consisting of up to 6.7 million units priced at 1.5 cents per unit for total proceeds of $100,500. Each unit will comprise one common share in the capital of the company and one non-transferable common share purchase warrant. Each warrant will…

-

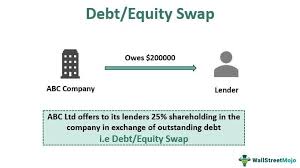

BARU Gold Closes Shares for Debt

BARU GOLD CLOSES SHARES FOR DEBT SETTLEMENT Baru Gold Corp. has approved the settlement of up to $162,782 of debt through the issuance of common shares of the company. Pursuant to the debt settlement, the company would issue up to 10,852,133 common shares of the company at a deemed price of 1.5 cents per share…

-

Lode Gold files NI 43-101 report for McIntyre Brook

2024-09-11 20:41 ET – News Release Ms. Wendy Chan reports LODE GOLD FILES NI 43-101 TECHNICAL REPORT FOR ITS MCINTYRE BROOK GOLD PROJECT IN NEW BRUNSWICK IN PREPARATION FOR SPIN OUT Lode Gold Resources Inc. has filed a technical report for its McIntyre Brook project, located in the emerging Appalachian gold belt in New Brunswick.…